Today, Kevin Warsh was announced as the next Federal Reserve Chair, set to succeed Jerome Powell in May. Warsh brings prior Fed experience and is widely respected across financial circles.

While markets reacted only slightly today, as his confirmation hearings approach and investors gain more clarity on his policy stance, we could begin to see mortgage markets respond more favorably.

Meanwhile, buyer activity continues to grow as early 2026 housing data shows improving demand. Since the beginning of the year, pending sales have been steadily climbing, pointing to buyer engagement beyond just a seasonal rebound. Mortgage purchase applications are also up 18% year over year — buyers are officially back.

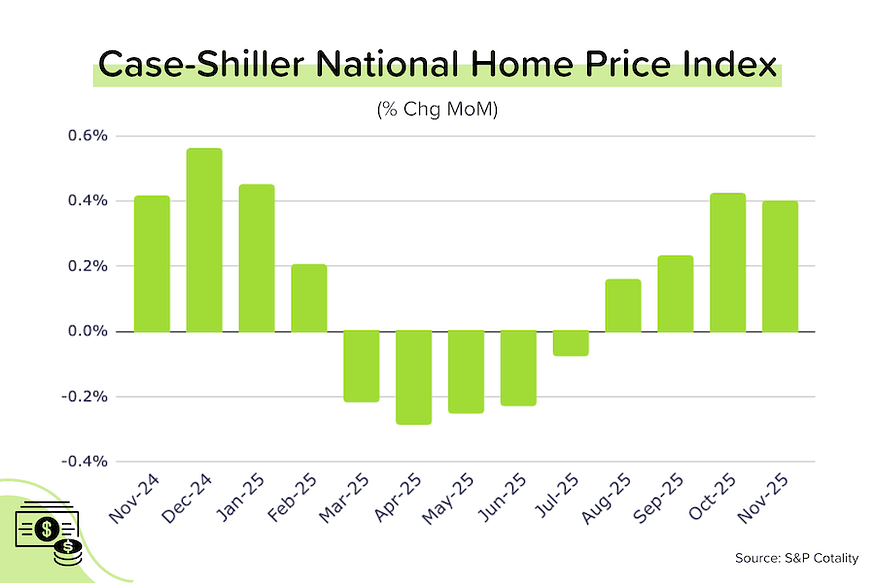

Along with renewed buyer demand, home prices are starting to rise again. For much of 2025, the Case-Shiller national home price index had slowed, but we’ve recently seen a reversal, with prices increasing 0.4% in both October and November. We expect this trend to continue as December data rolls in and we move further into 2026.

Across the board, lower and steadier mortgage rates are helping fuel buyer demand and home price growth. If you have been waiting on the sidelines, this could be a great time to start exploring options. We’re available happy to run scenarios or answer questions.